Who is Broadcom? The Unsung Giant That Overtook Tesla and Joined the Tech Elite

Many might still consider Tesla, Apple, or Meta the center of the tech universe, but a significant reshuffling has occurred behind the scenes. A lesser-known yet highly influential giant, Broadcom, not only surpassed Tesla's market value in 2024 but has firmly cemented its place among the most valuable companies in the United States by 2025, reshaping the famed "Magnificent Seven" group. But who exactly is Broadcom, and how did it achieve this feat?

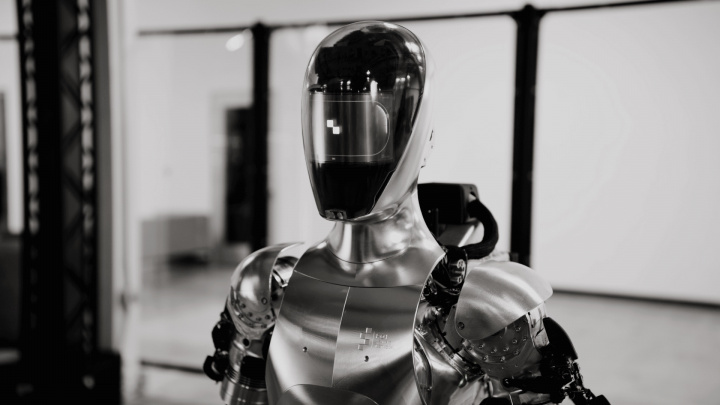

Broadcom: The Soaring Silent Giant of AI Infrastructure

Broadcom's spectacular rise, seeing its market value climb consistently **above $900 billion** by April 2025 (while Tesla's value hovered in the $550-$650 billion range), is driven by several key factors:

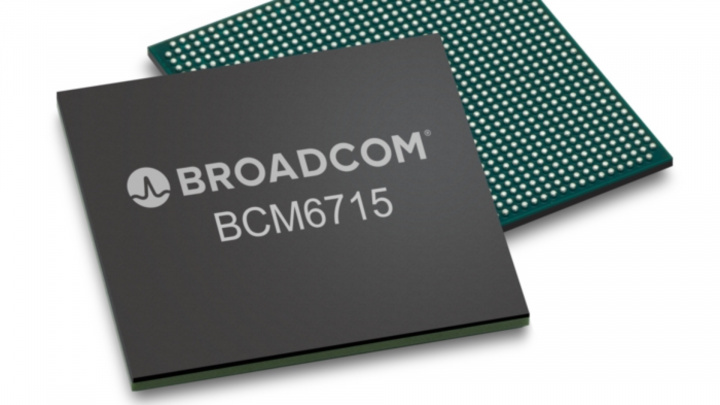

- AI Networking Dominance: Broadcom leads the market in high-end networking chips (e.g., Ethernet switches, router chips) used in data centers. The AI boom has created exponential demand for these components.

- Custom AI Accelerators (ASICs): Alongside Nvidia's GPUs, major cloud providers like Google and Meta increasingly rely on custom AI accelerators developed in partnership with Broadcom. This is a highly lucrative business.

- VMware Integration: The VMware acquisition complements the hardware business with stable, subscription-based software revenue, boosting the company's profitability and market weight.

- Strong Financial Performance: Driven by AI chip demand, Broadcom's AI-related revenue was expected to exceed $12 billion in 2024 (up from ~$4 billion in 2023), with growth continuing into 2025, potentially **surpassing $16-17 billion**.

Meet Broadcom (AVGO)!

While its name might not be as familiar as Apple or Microsoft, Broadcom Inc. is a global technology leader with roots tracing back to Hewlett-Packard's semiconductor division, founded in 1961. The modern company emerged from the 2016 merger of Avago Technologies and Broadcom Corporation (Avago acquired Broadcom and then adopted its name). Although legally incorporated in Singapore, its operational headquarters are in the heart of Silicon Valley, San Jose, California (USA).

Broadcom focuses on two main areas: semiconductor solutions (a wide range of chips for data centers, networking, broadband, wireless, storage, and industrial applications) and infrastructure software (primarily through the 2023 acquisition of VMware, a leader in virtualization and cloud infrastructure). It's a key player behind almost every modern technological system, from smartphones and data centers to factory automation.

Broadcom's success shows that the engines of the AI revolution include not only the software companies in the spotlight but also the critical hardware and infrastructure providers.

Tesla: Facing Headwinds in the EV Market

While Broadcom soared, Tesla's market value significantly declined from its peaks, settling firmly in the $550-$650 billion range by early 2025. The reasons include:

- Slowing EV Growth: Global moderation in demand for electric vehicles.

- Intensifying Competition: Especially from Chinese manufacturers and legacy automakers.

- Shifting Consumer Preferences: Increased interest in hybrid vehicles.

- Model Lineup and Pricing: Delays in new, cheaper models and profitability pressure from price cuts on existing ones.

The Reshuffled "Magnificent Seven": Broadcom vs. Eli Lilly

The composition of the informal "Magnificent Seven" group constantly shifts based on market value. As of April 2025, the most valuable US companies are typically (order may slightly vary):

- Microsoft (~$3+ trillion)

- Apple (Near ~$3 trillion)

- Nvidia (~$2.5+ trillion)

- Alphabet (Google)

- Amazon

- Meta Platforms

- Broadcom (~$900+ billion) and Eli Lilly (~$850-900+ billion) in a tight race for the 7th spot.

Therefore, Broadcom has not only displaced Tesla (which is no longer even in the Top 10) but has firmly entered the absolute elite, running neck-and-neck with the also soaring pharmaceutical giant Eli Lilly. This competition highlights the market's current high valuation of both AI and healthcare innovation.

Outlook: Stable Growth vs. Volatility

Market analysts remain optimistic about Broadcom's future, thanks to sustained demand for AI networking and chips, and the successful integration of VMware. The company's diversified portfolio and strong market position suggest a more stable growth trajectory.

Tesla's future continues to promise higher volatility. While the long-term potential of the EV market is undeniable, short-term challenges and competition may keep the stock price more sensitive to news and expectations.

Summary

Broadcom's ascent into the innermost circle of tech giants is not a fleeting phenomenon. As a key infrastructure provider for the AI era, complemented by the stable software leg of VMware, the company has permanently redrawn the map of the largest US corporations. While Tesla grapples with EV market challenges, Broadcom vies with Eli Lilly for the final spot in the "Magnificent Seven," demonstrating that technological and healthcare innovation are central to current market valuations.