Why Are Graphics Cards So Expensive?

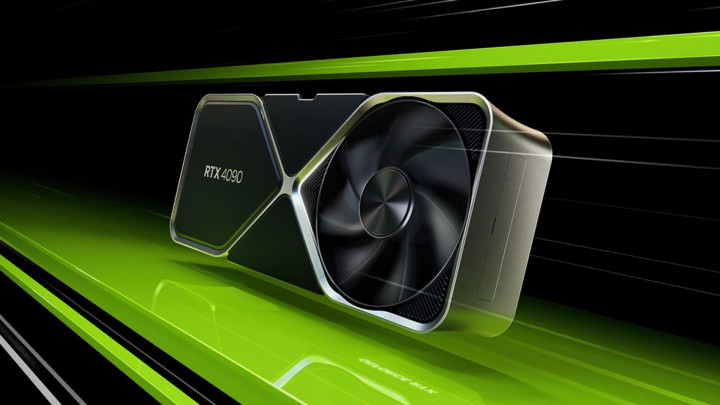

Graphics card prices have been sky-high for years, and this is due to complex, interconnected reasons. Often, a high-end graphics card (GPU) alone can cost more than all the other components of a computer combined, highlighting just how significant their price has become.

On the demand side, there's already significant need from traditional graphics applications (architectural design, 3D modeling, rendering) and the gaming industry, which demand increasingly realistic and detailed graphics. Added to this is the explosive growth of machine learning and deep learning, where the parallel processing capabilities of GPUs are indispensable.

The Video Game Industry and Market

- In 2024, the global video game market was valued at approximately $272.67 billion, and it's projected to reach $345.34 billion by 2025, showing significant growth compared to the previous year.

- Some sources suggest the market value could even climb to $503.14 billion in 2025, highlighting differing forecasts due to various methodologies.

- Mobile gaming continues to dominate; for instance, in 2024, half of the revenue ($92.5 billion) came from this segment. The PC and console gaming markets contributed smaller shares ($41.5 billion and $50.3 billion, respectively).

The industry's growth is driven by factors like the widespread availability of mobile games, new technologies (e.g., VR/AR), and the continuous expansion of the user base.

This already strained market was further burdened by cryptocurrency mining, acting as a kind of "non-organic" demand surge (driven by external speculation rather than core computing needs), which periodically resulted in extreme prices (not to mention inventory shortages and supply problems). While the impact of crypto fluctuates due to market volatility, and newer Proof-of-Stake (PoS) systems are replacing older energy-intensive Proof-of-Work (PoW) systems (reducing the need for raw computing power), the recent rise of LLMs (Large Language Models) represents another, and arguably more "organic," demand factor. These models require massive computational capacity, further increasing pressure on the high-end graphics card market. Considering current trends and forecasts, we can expect sustained and significant growth from LLMs in the coming years.

However, demand alone doesn't explain the situation. There are significant issues on the supply side as well: the global chip shortage and supply chain problems (such as the effects of the COVID-19 pandemic) significantly contributed to price increases, independent of demand. Manufacturing the most advanced chips is increasingly complex and expensive; new production technologies like EUV lithography require huge investments, which are also reflected in the final product prices.

Behind the production of graphics cards, and modern high-performance chips in general, stand two crucial companies that are almost indispensable for the most advanced technologies: ASML from the Netherlands and TSMC from Taiwan. ASML holds a virtual monopoly in the market for extreme ultraviolet (EUV) lithography equipment. These machines, costing hundreds of millions of dollars each, are essential for manufacturing the smallest and most complex chips, including modern GPUs. Currently, no other company can supply EUV systems at this level, giving ASML a de facto monopoly.

TSMC, meanwhile, is the world's largest contract chip manufacturer (foundry), producing chips for numerous major tech companies, including Nvidia, AMD, and Apple. Although TSMC doesn't have a formal monopoly, its technological lead and capacity in the most advanced manufacturing nodes (e.g., 5nm, 3nm, 2nm) are such that competitors (like Samsung, Intel) currently cannot offer a viable alternative for producing cutting-edge chips at scale. These two companies, ASML for manufacturing equipment and TSMC for production capacity, represent a kind of bottleneck in the global chip industry. They play a key role in determining which chips are available, in what quantities, and at what price, including graphics cards.

General inflation also impacts the graphics card market, just like any other product. Although not the primary cause, the activities of resellers and "scalpers" also contribute to market price distortions, especially for popular models, by buying up limited stock and reselling it at higher prices.

All these factors combined have contributed to Nvidia becoming – not by chance – one of the world's most valuable companies, leveraging its early and significant investments in GPU-based computing, particularly through its CUDA platform and Tensor Cores. Although there is competition in the market (e.g., from AMD), Nvidia's dominant position, especially in the high-end segment and AI applications, allows them to set higher prices because their technological advantage makes their products less easily substitutable.

Competitors like AMD, Intel, and even Samsung, while trying to catch up, are currently lagging in this area and are only recently starting to show significant progress in the AI accelerator market.