SoftBank's $100 Billion Gambit: Aiming for AI Chip Supremacy Against Nvidia

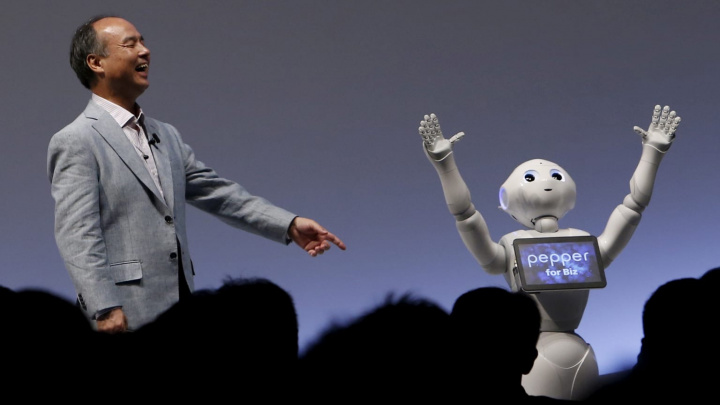

In a bold move signaling massive ambition in the artificial intelligence arena, Masayoshi Son's SoftBank Group is reportedly planning to raise a colossal $100 billion for a new chip venture. Codenamed "Izanagi," this initiative aims to establish a powerhouse capable of supplying essential semiconductors for AI, directly challenging the current market leader, Nvidia, and leveraging SoftBank's majority-owned chip designer, Arm Holdings.

The exponential growth of the AI chip market, supercharged by the rise of generative AI models like ChatGPT, has created an intense technological arms race. SoftBank, under the leadership of founder Masayoshi Son, is undergoing a strategic realignment, placing AI firmly at its core. Central to this vision is Project Izanagi, named after the Japanese god of creation. Son envisions creating a company that can compete head-on with Nvidia in the AI semiconductor space, potentially complementing the chip design capabilities of Arm Holdings.

The funding target is staggering: SoftBank itself might invest $30 billion, with an additional $70 billion potentially sourced from institutions in the Middle East. This ambitious plan highlights SoftBank's conviction in the future of AI and its determination to transition from a broad investment holding company to a central force in AI infrastructure. This pivot involves strategic divestments, such as selling Alibaba shares, to redirect capital towards AI and related technology ventures.

Currently, the AI chip landscape is overwhelmingly dominated by Nvidia. Recognizing the AI revolution's potential early on, Nvidia leveraged its expertise in Graphics Processing Units (GPUs), whose parallel processing capabilities are exceptionally well-suited for AI computations. Coupled with its proprietary CUDA (Compute Unified Device Architecture) software platform, Nvidia built a powerful hardware and software ecosystem. This ecosystem attracts millions of developers and gives Nvidia an estimated market share exceeding 80% in AI data center chips. Demand for its processors, like the H100 Tensor Core GPU, remains incredibly high, cementing its position as the primary choice for developing and running demanding AI applications.

While competitors like AMD and Intel are striving to catch up, they face significant challenges. AMD has made strides, introducing chips like the MI300X designed to compete with Nvidia's offerings, often highlighting advantages like larger memory capacity. Intel, despite holding less than 1% of the discrete AI accelerator market, recently unveiled new AI chips like the Gaudi 3 and is investing heavily in expanding manufacturing capacity, partly fueled by government subsidies, hoping to challenge Nvidia's reign.

Within this competitive field, SoftBank sees its majority stake in Arm Holdings as a key strategic asset. Arm designs the fundamental architecture used in the vast majority of the world's smartphones, tablets, and countless other devices, known for its power efficiency. While Nvidia dominates the high-performance training aspect of AI with its GPUs, Arm's CPU designs are increasingly sought after to work alongside accelerators in AI data centers for tasks like inference and overall system management. Arm's business model revolves around licensing its intellectual property (IP), and the Izanagi venture could potentially design powerful AI chips based on or complementary to Arm's architecture, creating synergies within the SoftBank group. Son has referred to Arm as the "core of the core" for SoftBank's AI strategy.

SoftBank's massive bet with Project Izanagi comes as the company returns to profitability after navigating a more defensive investment stance post-pandemic due to rising interest rates. If successful, this $100 billion venture could significantly reshape the AI semiconductor market, potentially creating a formidable competitor to Nvidia and establishing SoftBank as a central player in the hardware foundation of the AI revolution.